Food retail supply chains are undergoing shocks and logjams that are raising prices and disrupting fill rates. Last week we took a deep dive into one aspect of this, what is behind the hesitancy of workers to fill the many job openings in the retail and wholesale food sector. This week we look at structural issues with logistics, commodity prices and what is wrong with the current set of practices that led us to this mess.

In terms of logistics, ocean-going freight rates have skyrocketed over 460% in the last 12 months. These shipping costs have been impacted by soaring pandemic demand, particularly the promised rapidity and convenience of online shopping, especially with increased automation, rapid delivery firms and micro-fulfillment expansion. With many working class consumers temporarily flush with spending cash from stimulus checks and child tax credits, demand has stayed relatively high for consumables. This has compounded pressure on backed up ports with several weeks’ worth of container ship traffic in port, too few ships, too few dockworkers, a shortage of semiconductors slowing down new truck production, and too few truckers to handle the existing freight. The millions of consumer products manufactured in China can’t magically appear in warehouses without efficient shipping infrastructure. And with a handful of firms controlling 80% of global shipping, the Biden administration is looking to take anti-monopoly actions to bring prices down, but that will not have immediate impacts.

Two billion pallets circulate in the U.S. economy. And they are getting harder to come by.

getty

Even less visible to consumers are the pallets that carry almost all shipped freight. Nearly 2 billion pallets circulate in the U.S. economy, mostly made of wood. Nearly every packaged product, piece of meat or fruit or durable consumer good we buy has been stacked and shrink wrapped onto a pallet. Pallet costs are up over 400% due to demand spikes and higher lumber costs, which have since come down. And trucking capacity also impacts this sector, with not enough trucks or drivers available to deliver, reposition pallets and/or move them around to where they are needed most.

In terms of food itself, the higher price tags discussed by my friend in Part 1 of this series are all too real. IRI has reported that 56% of customers are somewhat concerned about the price of food and nearly a third feel that prices are much higher than before the pandemic. The all-items price index is up over 5.4% for the last 12 months, the largest spike since the previous financial crisis in 2008, and producer costs have jumped over 7%, the biggest spike since 2010. The USDA is predicting the prices of food consumed at home to jump 2.5%-3.5% this year, on top of the 3.5% from 2019-2020. Grain prices are up 94% over the last year and oilseeds are up 68% in the same period. These commodities, along with spiking demand for stay-at home eating, have sent meat and poultry prices up 13% over 2019. The producer price index for meat is currently in the high teens to low twenties, in particular beef and chicken, with chicken breasts up 61%. The deadly meat plant speeds ups ordered by the Trump Administration that sickened and killed scores of workers were mostly able to meet the 2020-21 consumer demand spikes, with the added help of $38 Billion in annual federal subsidies. But investment bank analysts predict consumption patterns will soon level off due to these higher prices and reductions in government stimulus and unemployment benefits. That is, consumers will eat less meat because they won’t be to afford it, especially if they don’t have a place to live.

Global supply chains are long distance, complex and extremely fragile. (Photo by Justin … [+]

Getty Images

These industry wide cost pressures mean that retailers cannot forward buy or bridge buy inventory to hold prices, and they are constantly watching prices at competition to see who will move and how much. The algorithms and machine learning that retailers typically use to hold pricing by balancing margins with price and demand elasticity, are not able to make up for such force majeure increases. Retailers eventually have to pass on retail price increases, decrease promotional markdowns to preserve their gross margins, and not cannibalize their typically thin rates of profit. And these retail price increases may erode much of the recent social safety net income which has alleviated some food insecurity, including stimulus checks, higher SNAP benefits and child tax credits, and which has also benefitted retailers. And more frightening for retailers and wholesalers, consumer demand looks to be even more erratic, with an inconsistent array of public safety and commercial Covid-19 policies being implemented from state to state and even county to county.

At the heart of these concerns is the modern operating practice of Just In Time capitalism. Similar to lean production methods, the intention of Just In Time is to optimize productivity, cash flow management, and ultimately, profitability for the supply chain. All actors in the supply chain keep inventories low, while pace and frequency of shipments are high and depend on predictable, seasonal trends of demand and production to stay in sync. The theory is that all inefficiencies are driven out of the distribution system, so that raw materials are brought to the production process, labor is scheduled on demand, and packaged products sent to retail stores, exactly when the algorithms and forecasts say they are needed. Such calculations typically account for customer behavior, item level or category-specific price elasticities, seasonality fluctuations, as well as planned promotions and marketing events. Sure, there is slight wiggle room for growth or contraction depending on the category, industry or sector. But all is geared towards achieving that slim bottom line under the most stable of circumstances. Just In Time is a fragile, inflexible system built for the best case scenarios and a nearly extinct sense of normalcy that financialization and the free market can solve everything. It’s safe to say that global capitalism, in all its vastness and complexity, is built on a digital house of cards.

Winter Storm Uri added additional strain to pandemic-early supply chains. (Photo by FRANCOIS … [+]

AFP via Getty Images

But systemic shocks have obliterated this paradigm. Under the best of current circumstances, it may take months or years for the supply chain to find some equilibrium. Where I live in Austin, despite the best efforts of retail staff, it took some food retailers over two months to recover from the compound shock of Winter Storm Uri and Covid-19 in February 2021. The pandemic, plus more frequent shocks such as hurricanes, wildfires, floods, poorly planned trade deal exits, or the social unrest that is inevitable based on the climate data that released IPCC has recently, are all deafening signals that mean we must reprioritize the functions and operations of supply chains.

In the meantime, we should take the impetus to reprioritize what matters in the food system. We’ve already discussed what the retail sector can do to attract and retain workers. Next, we should classify food as a human right, particularly after a year when up to 1 in 4 households experienced food insecurity. We should continue to expand SNAP and Child Tax Credits that are saving lives and combatting food insecurity more effectively than private sector efforts. Food and raw material prices should shift to true-cost accounting models so that all externalities and subsidies are taken into consideration of pricing. And as Raj Patel notes in an upcoming NatureFood article, large scale institutions should adopt Good Food Purchasing Program frameworks and prioritize sustainability, social justice and compassion in supply chains, as well as greater transparency and participation with community members.

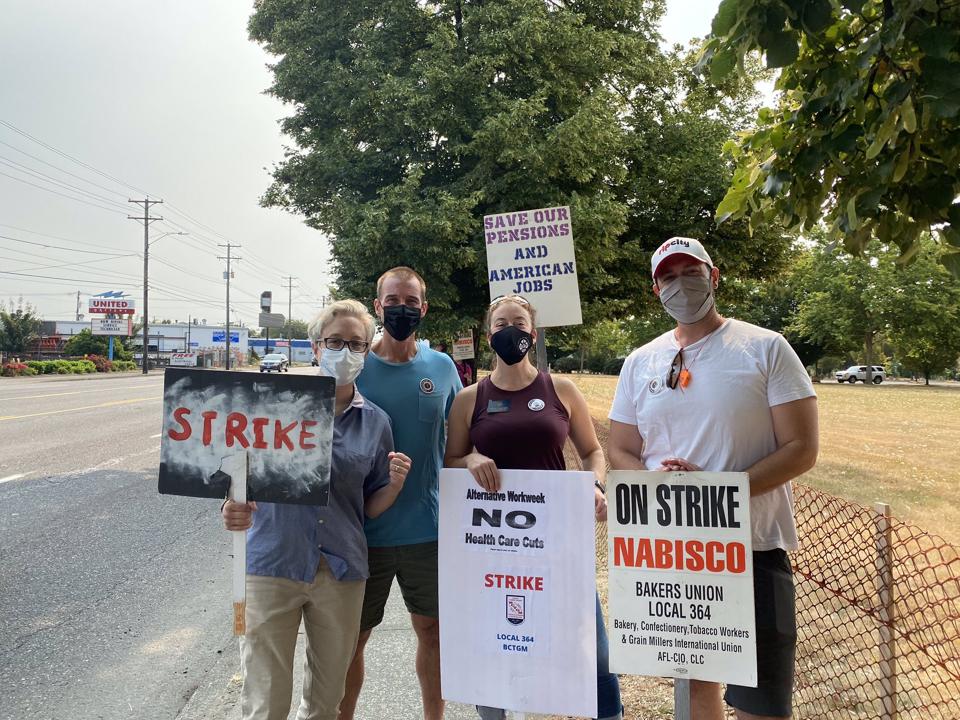

Unionized Nabisco workers are on strike across the country, protesting plant closures and cutbacks.

Mike Burlingham/BCTGM Bakers Union Local 364

Trade policies must prevent offshoring and capital flight, such as the Mondelez plant closures and cutbacks that instigated the ongoing Nabisco strike wave by bakery workers. Policy makers should expand the public sector, including public food utilities and food commons, and create more domestic and regional manufacturing and processing capacity so that supply chains are less fragile and more diverse. They should also pursue aggressive anti-trust agendas to regulate and break up “power buyers”and industry monopsonies whose concentration of economic power has given them extraordinary leverage over the food system. And supply chain workers should organize and design systems to move past Just In Time. We need inventory management and procurement systems that prioritize anti-fragility, sustainability, access and equity instead of narrowly defined productivity and profit goals. This may be our last, best chance to course correct.